If you’ve ever bought a house in the United States or Canada, you’ve probably heard of something known as an escrow account. But what if you’re buying a home in Mexico? Do you need an escrow account?

The answer: it depends. But first, let me explain what an escrow account is.

What’s an escrow account?

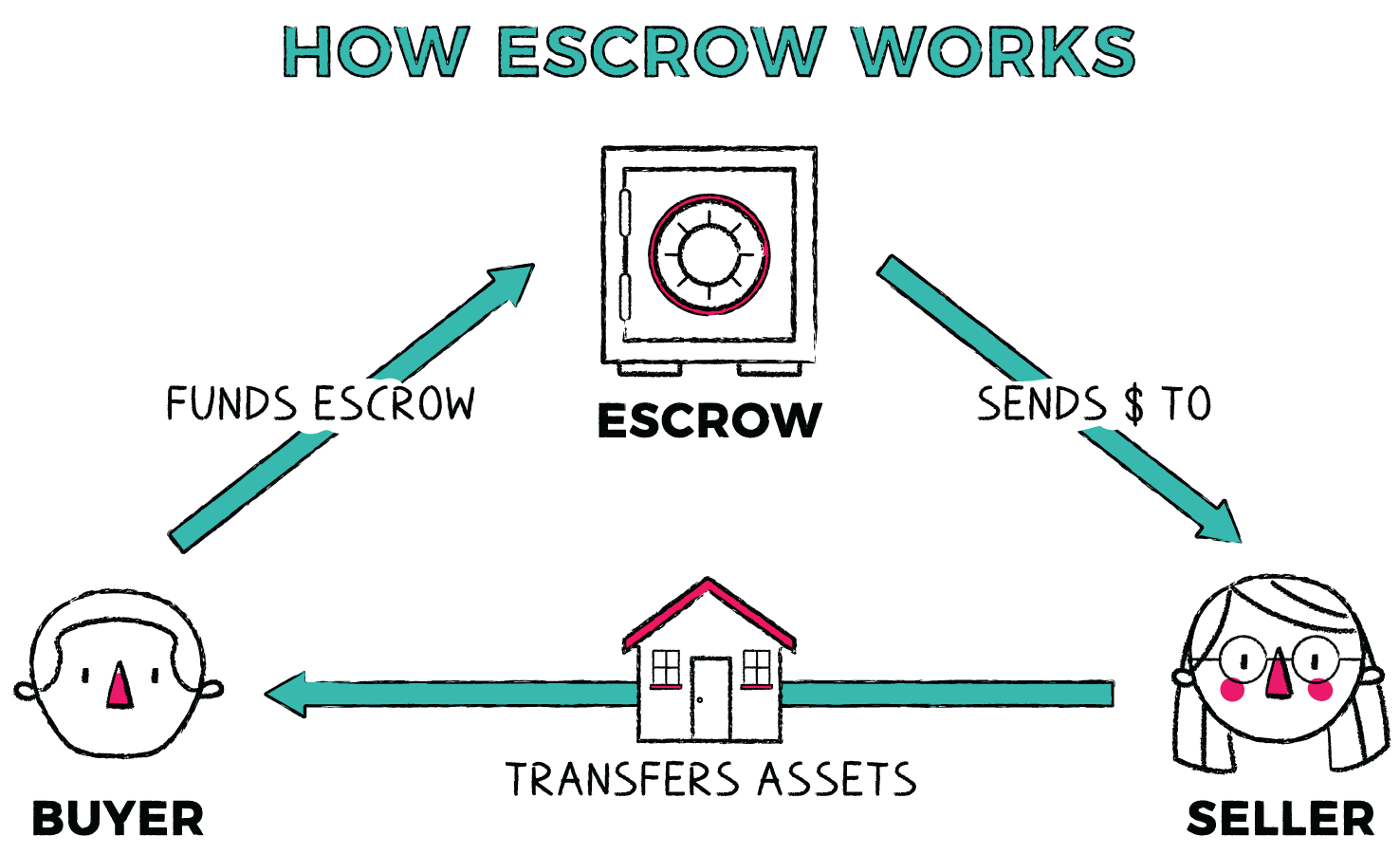

An escrow account is a legal arrangement where a third party temporarily holds large sums of money or property until a particular condition has been completed. For example, once you close on the purchase of a property, then the third party releases your escrow amount to the buyer.

It is most commonly used in real estate transactions to protect both the buyer and the seller throughout the home buying process. Escrow accounts are not automatically offered during a real estate transaction. If you want to have one, you need to inquire about one, and both you and the seller have to agree upon using one.

Do you need an escrow account in Mexico?

If you were to ask a local Mexican if they used an escrow account when buying or selling their house, the answer would most likely be NO.

You see, in Mexico, escrow accounts are not standard. Escrow accounts only became popular when foreigners from the United States or Canada began buying properties in Mexico and wanted a less risky way to ensure the seller wouldn’t run with their deposit while negotiations for purchasing a house were still in process.

Most local Mexicans pay the seller a deposit directly once they have agreed on the sale price of a house. This is a way of showing “good faith” that you are serious about moving forward with the purchase. Then, once the sale has gone through and the Notario has approved the deed is clear, and the house is okay to sell, the buyer pays the seller in full.

This is the “closing” process of a real estate transaction.

Most houses in Mexico bought by foreigners are paid in cash, so there isn’t usually a mortgage company or financial institution involved in the real estate transaction. Credit and lending in Mexico are complicated, and interest rates are very high compared to the U.S. and Canada. So financing a house is not how the majority of foreigners buy their homes.

Who Manages Escrow Accounts in Mexico?

But if having an escrow account is not common in Mexico, who would you go to if you wanted to have a third party manage your deposit?

The answer- most likely your realtor or, in some cases, a real estate lawyer or real estate law firm. Many real estate companies manage escrow accounts for this reason. As escrow becomes more well-known in Mexico, the demand for this type of service is rising.

In Mexico, funds are customarily held in the realtor, developer or lawyer’s personal bank account. The account is uninsured and susceptible to seizure or liens. Although the broker or lawyer will hold your funds with good intentions, their creditors and tax authorities (SAT) will have access to these accounts. The accounts are not protected as they are elsewhere in North America.

To secure your deposit or payment, you should use an Escrow Service which is insured and held in a Canadian or American bank in a segregated account. There are services that offer these services in Mexico to foreigners.

But if you don’t use an escrow service protected in the USA or Canada, to truly make sure you can trust the person who will manage your cash, whether a realtor or real estate attorney, you should do a lot of research and only work with reputable professionals.

Other Things You Should Know

Unlike escrow accounts in the U.S., escrow in Mexico works differently. For example, the escrow account company does not pay bills, pay taxes, utilities, or enforce the purchase contract terms. Instead, their only responsibility is to hold and disburse the funds when the contract terms have been met.

In Mexico, buying real estate can be done in many different ways. Although it is not common, some people offer seller financing. In these cases, escrow accounts are also not standard because the seller is financing the sale, usually through monthly payments.

Also, this third-party system comes with management fees and specific stipulations, but it may be the best option in some cases. It ultimately depends on your level of comfort, the real estate company you are working with, your trust in them, and of course, the amount the escrow account will manage on your behalf.

Although there are some protections available to you, such as the Anti-Laundering Law- which requires all financial institutions to obtain, verify and record information that identifies each person who opens any type of account within a financial institution. It’s still essential that you do your research when having a third-party manage your money.