One of your main questions about moving to Mexico might be “How Will I Access My Money in Mexico?”

Here are a few ways:

Using Your Debit/Credit Card

While cash is still very much king in Mexico, you can easily use your debit/credit card for most everyday purchases, such as restaurants, bars, concerts, sporting events, groceries, delivery services, pharmacies, medical care, utilities, and other such purchases.

But just be careful, as those international fees can add up if you don’t have a card with low fees.

For this reason, a lot of U.S. expats living in Mexico choose to have a credit card with no international transaction fees. Here are some of the popular ones:

- Capital One Quicksilver Cash Rewards Credit Card

- Wells Fargo Autograph

- Chase Sapphire Preferred Credit Card

- Bank of America Travel Rewards Credit Card

- Apple Card

Here are a few more options through Nerd Wallet.

Charles Schwab Investor Checking Account

I know many U.S. citizens who have a Charles Bank Investor checking account.

When applying for your Schwab High Yield Investor checking account, you will also be required to open a Schwab brokerage account if you don’t already have one.

This brokerage account is opened automatically when you open a Schwab checking account, but don’t worry: It’s also free and has no minimum deposit or fees.

That means you can use the checking account and never worry about the brokerage side if you don’t want to.

With Charles Schwab, you get a hassle-free ATM withdrawal policy that lets you withdraw money from any ATM worldwide at no cost. I also have ZERO foreign transaction fees.

If you travel between the U.S. and Mexico, you don’t have to worry about contacting one credit card’s customer service instead of using another one to save on these extra fees. It saves you the headache. However, you’ll still need a Mexican bank account to pay for services such as your electric and internet bills.

Sign Up For A Wise Card

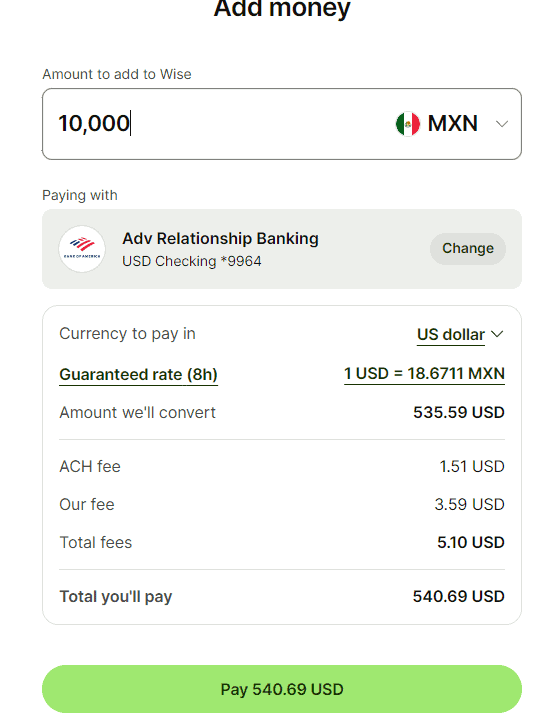

A popular way many expats bypass having a Mexican bank account while still being able to access pesos is to apply for a Wise Debit Card. It’s free to order, and their fees are relatively low compared to other international transaction fees.

What’s awesome about this card is that it allows you to hold funds in many currencies, including Pesos (MXN). Think of it like a Visa gift card—you add funds to it and can use it wherever a Visa is accepted.

So, when the peso exchange rate is favorable, you can buy Pesos and take advantage of the exchange rates.

See example below:

When you transact using your Wise card, it will take the current exchange rate and charge you a small fee. You also get 2 free withdrawals per calendar month with a cap on the amount you can withdraw before it charges you a percentage.

It isn’t really meant to be an ATM card but rather a way to hold Pesos in a debit card to use wherever debit/credit cards are accepted and to help you get the most out of the best exchange rates.

You can find out more about it here.

Check Out Our Banking Tips Video

Bank-to-Bank Transfer

One of the cheapest ways to get money from your foreign bank account to Mexico is by making a bank-to-bank transfer.

However, that means you will need to have a bank account in Mexico. To transfer money from one account to the other, we recommend using XE.

Xe offers a competitive exchange rate when compared to other services like Wise or Remitly. But what stands out about XE is their low fees for transferring large amounts of money at a time. They seem to have the lowest fees when compared to other services.

Many people also use Remitly or Wise. So, it’s a good idea to compare fees on all platforms before sending a large amount of money where fees can add up.

However, it’s also worth looking into doing a wire transfer depending on the amount you are transferring because Remitly and Wise charge a percentage of the amount you are transferring. Whereas some banks charge a flat rate for wire transfers if they are under a specific amount. It’s worth looking into both options and determining which one will cost you the least.

A pro tip for living in Mexico is to get pesos when the exchange rates are most favorable to you. So, I highly suggest you sign up for XE exchange alerts. That way, you know the best time to move money to your Mexican bank accounts or the best time to withdraw pesos to get the most money.

For example, earlier today, the exchange rate of Pesos to USD was the best it had been in over a year.

It’s completely free to sign up, and you’ll get a daily email with the exchange rates you set. Go to Xe.com and sign up for rate alerts.

Additional Reading- How to Open A Bank Account in Mexico

Withdraw Cash As Needed

Many expats living in Mexico never open bank accounts there. So, how do they access their money?

Well, believe it or not, most of them just make withdrawals from their nearest ATM whenever cash is needed.

The only caveat is that ATM fees can add up, and your foreign bank will most likely charge you an international transaction fee. (unless you have a Charles Schwab Investor Account and their Debit Card with no ATM or international transaction fees.)

Another downside to relying on ATMs is the limits you may have on withdrawals by your bank. Which is why we recommend opening a bank account in Mexico. One pro tip about living in Mexico is to avoid ATMs on the 15th and 30th of each month. These are paydays in Mexico, and because Mexico is still very much a cash society, you’ll likely be stuck in a line of people also trying to withdraw cash. And because of the rush, it’s not unusual for ATMs to run out of money.

Instead, we recommend withdrawing a bit each week to make up your monthly amount. That way, you are also not competing for cash, and you’re not carrying a large amount each time.

Another pro tip: When withdrawing cash from an ATM in Mexico that you do not bank with, you should always decline the conversion rate the ATM is suggesting. Your bank back home will always give you a better exchange rate than most banks in Mexico.

What’s Best For You

Accessing your money while living in Mexico can be straightforward with the right tools and strategies.

Whether you prefer using your debit or credit card, opening a local bank account, or utilizing international services like Charles Schwab or Wise, there are multiple options to suit your needs.

You may go on Facebook groups and see posts from hundreds of people sharing what works best for them. But what works best for someone else might not be what works best for you.

It’s important to consider fees, exchange rates, and convenience when making your choice. By planning ahead and taking advantage of favorable exchange rates and low-fee cards, you can manage your finances efficiently and avoid unnecessary costs.

Ultimately, the key is to find the method that best aligns with your habits and lifestyle, ensuring a smooth transition to your new life in Mexico.