This article was co-written by one of our recommended Medicare Advantage brokers specializing in helping expats living in Mexico. See our COMPLETE Mexico Relocation Guide for a full directory of recommended contacts

Mexico is popular for its high-quality and affordable healthcare. You can consult a top-notch general physician for just $20-30. Paying out of pocket works well for day-to-day healthcare needs. BUT medical bills can skyrocket in an emergency and send you broke, even in Mexico.

That’s why you need a backup plan.

One option is maintaining a U.S. Medicare Advantage plan that covers you in Mexico. But it’s not very straightforward because the residency rules vary between Medicare

plans.

I get many questions about Medicare residency requirements. It’s an important factor for retirees who travel and spend most of their time outside the U.S. So, let’s look at different Medicare plans and coverage in Mexico.

Medicare plans and coverages in Mexico

Medicare Plans A and B provide almost no coverage outside the U.S.

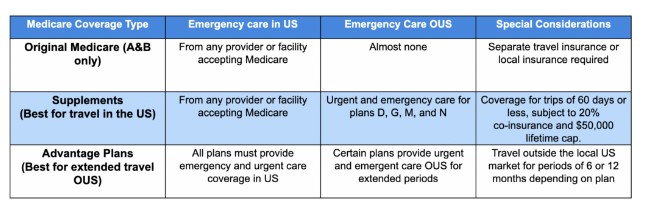

But certain Supplement plans and Medicare Advantage plans may cover you for emergency and urgent care outside the U.S.

Here’s a snapshot of Medicare coverages:

In summary, supplement plans are great for travelers within the U.S., and advantage plans are better for travelers outside the U.S.

Supplement plans

Supplement plans, also called Medigap plans, will cover certain

healthcare expenses not covered in Medicare Plan A and Plan B. These are ideal for snowbirds and others who maintain two residences in the U.S.

Because you can use your Supplement plan anywhere in the U.S., You don’t have to change plans when you move states. The plans directly pay the providers without too much needed on your end. The location of your permanent residence matters to access supplement plans and get the best deals.

Medicare Advantage Plans

Here’s where your residency really matters.

Advantage plans cover a limited geographic area based on zip codes. These plans are designed to provide managed care to residents within a particular area (home market). They offer limited coverage outside the home market. As shown in the above table, all advantage plans can be used anywhere within the U.S. for emergency care. You can also use them at certain Preferred Provider Organizations (PPOs) and related out-of- network plan options for an additional cost.

Advantage plans usually allow up to 6 months of continuous travel outside the home market. Nowadays, some plans allow up to 12 months outside the home market. If an Advantage plan member moves out of their home market, they must report the move to your plan. And they can enroll in another plan in their new home market.

What do Advantage Plans Cover Outside The U.S.?

Certain Advantage plans may cover some or all of the following when living in Mexico :

- Emergency care

- Urgent care

- Coverage with monetary caps (typically $50,000 to $250,000)

- Coverage with no monetary caps

- Coverage for up to 6 or 12 months outside the Home Market

- The potential for co-payment requirements

- The potential for co-insurance requirements

- Coverage for emergency transport

All these rules and variables can make selecting the right plan complicated and time-consuming. But if you’re a frequent traveler who spends much time overseas, having a good Medicare plan that covers you in Mexico is well worth the hassle.

How Can You Lose Your Plan?

Extended travel can equal moving. And Medicare Advantage plans are designed around local care delivery networks. Accessing this care becomes difficult if you move out of the home area.

For example, if you move out of your home market or travel for over 6 months, your Plan Sponsor must disenroll you. That happens if you tell them or they find out from another source, like when a change gets reported to Social Security. But they’re under no obligation to monitor beneficiaries’ whereabouts.

And the beneficiaries have no obligation to tell them. The dis-enrollment process is the same for moves or extended travel. If the plan decides you have moved, they’ll give you notice and a Special Enrollment Period (SEP) to enroll in a new plan. There’s no concept of retroactive dis-enrollment.

This means the plan must give you notice and honor claims up to the point of disenrollment.

You’re also not prohibited from moving back to your original home market or selecting a new location. You won’t face any penalties. According to Medicare rules, you just moved locations. The system aims to ensure beneficiaries are not left without

adequate coverage when they move or travel.

See the Federal Code of Regulations for detailed rules.

U.S. Mailing Address Can Mean Residency

According to Social Security, a U.S. mailing address generally indicates U.S. residency. Here’re two key points they note:

- Less than 6 months of absence from the U.S. with no intention of abandoning U.S. residency does not terminate or interrupt an individual’s period of U.S. residency.

- More than 6 months of absence from the U.S. is not considered temporary unless there is a strong indication that the individual is maintaining U.S. residency. Such indications include maintaining a house or apartment in the U.S., paying U.S. income taxes as a U.S. resident while abroad, and other similar acts.

From Medicare’s point of view, defining residency is a complicated concept. They require a physical address that’s not a mailbox. But they must also respect beneficiaries’ lifestyle decisions, like wanting to travel most of the time, live in an RV, or become a digital nomad.

In short, Medicare must be flexible enough to accommodate the lifestyle desires of its beneficiaries. Medicare is a benefit both earned and paid for by the beneficiaries.

You Can Only Have One U.S. Residence for Medicare

Medicare only cares about your U.S. residency status. It’s not based on your U.S. or any other country’s citizenship.

According to Social Security, a beneficiary should meet two or more of the following criteria, which they call “convincing evidence” of residency in the U.S., for SSI benefits.

- Property, income, or other tax forms or receipts

- Proof of U.S. home ownership or rental lease or rent payment record

- Utility bills addressed to the claimant

- U.S. driver’s license

- Telephone directory listing

- Regular and frequent participation in social programs such as vocational rehabilitation, Meals on Wheels, or evidence showing that the claimant regularly receives services from a social agency

- Proof of employment, such as pay stubs or a contract

- Proof of active participation in a religious, fraternal, or social organization

- A record of volunteer activity that shows regular and frequent performance

- Clinic cards or doctor’s record showing dates of visits for regular medical treatment

- Proof of a local U.S. bank account or check-cashing card at a local establishment

- Correspondence addressed to the claimant

SSI is an unearned benefit aimed at preventing poverty in the elderly and disabled U.S. residents. So, these criteria are the most exacting standards Medicare beneficiaries can expect.

If you plan to spend much time outside your home market, consider the above criteria carefully. Remember, Bank accounts, mailing addresses, vehicle registrations (including tax payments and insurance on them), property ownership, and annual doctor visits all count for evidence of residency. And you only really need two.

One thing to remember is that residency, in this instance, is completely a legal construct. It shouldn’t be mixed with your personal concepts of home. Medicare doesn’t require demonstrating your home, hearth, and gardens.

Consider Medicare when Choosing your Residency

Maybe you’ve recently retired and are excited to start a nomadic life and catch up with long-overdue travel. Or maybe you want to move to Mexico!

Consider Medicare and how your residency will work when making your decisions because access to a Medicare plan means healthcare at reasonable costs. And your residency will impact access to care, taxes, and Medicare Supplement and Advantage plans’ availability.

Medicare conflates moving with travel away from a home market. But as discussed earlier, they recognize they’re not the same thing. Moving away from your home market will not invalidate service claims before disenrollment. And there’s an automatic SEP for disenrolled people to ensure no break in coverage.

Medicare Advantage plans may conflate moving with time out of the home market. But the system aims to enroll the beneficiary in a plan in their home market and not deny care.

The good news is we are beginning to see plans with much broader concepts of home market.

I know understanding the rules around Medicare, if you qualify, finding the plans that’ll cover you in Mexico, etc., and making claims can be complicated. That’s why it’s best to find a good broker to help you through the process.

Watch our Video Q&A to learn more about using Medicare Advantage in Mexico.

There’s Also Health Insurance in Mexico

Mexico also has public healthcare programs called Instituto Medico del Seguro Social (IMSS). But remember, the public hospitals in Mexico are not on par with the private hospitals. You’d want top-notch healthcare – meaning access to private hospitals during an emergency.

You can get affordable private insurance in Mexico. But there’re rules around who qualifies. And it gets harder to find coverage after age 70.

But don’t stress. There’s always a solution. To learn more about healthcare in Mexico, read my article: What Are Your Healthcare Options in Mexico?