You’ve probably heard that one of the reasons so many expats move to Mexico is the lower cost of living. Included in this “low cost of living” statement is medical care.

And that’s because most medical treatments in Mexico cost a fraction of what they do North of The Border. And if you’re researching a move to Mexico, medical care will undoubtedly be one of the main things you’ll look into.

And you’re probably wondering what your healthcare options are in Mexico?

Let me help you understand some of them.

Note: this blog is for information purposes only. I am neither a doctor nor an insurance agent.

Mexican Healthcare Is One Of The Best In The World

You can ask any foreigner who has moved to Mexico and had any medical experiences here what their thoughts are. And 9 out of 10 times, they’ll tell you how amazing their experience was.

Usually, it starts with the doctors. Doctors in Mexico take the time to understand your needs. They really spend time with you as a patient, and you never feel rushed to leave their office. In some cases, our doctors become our friends. We have their personal number. And they check in on us. Something we aren’t used to if you’re from the U.S.

The nursing staff is usually also very kind and professional too.

But one of the things that retirees enjoy the most from living in Mexico is the savings on medical expenses. As an example, medications are not only cheaper, but many of them are available over the counter.

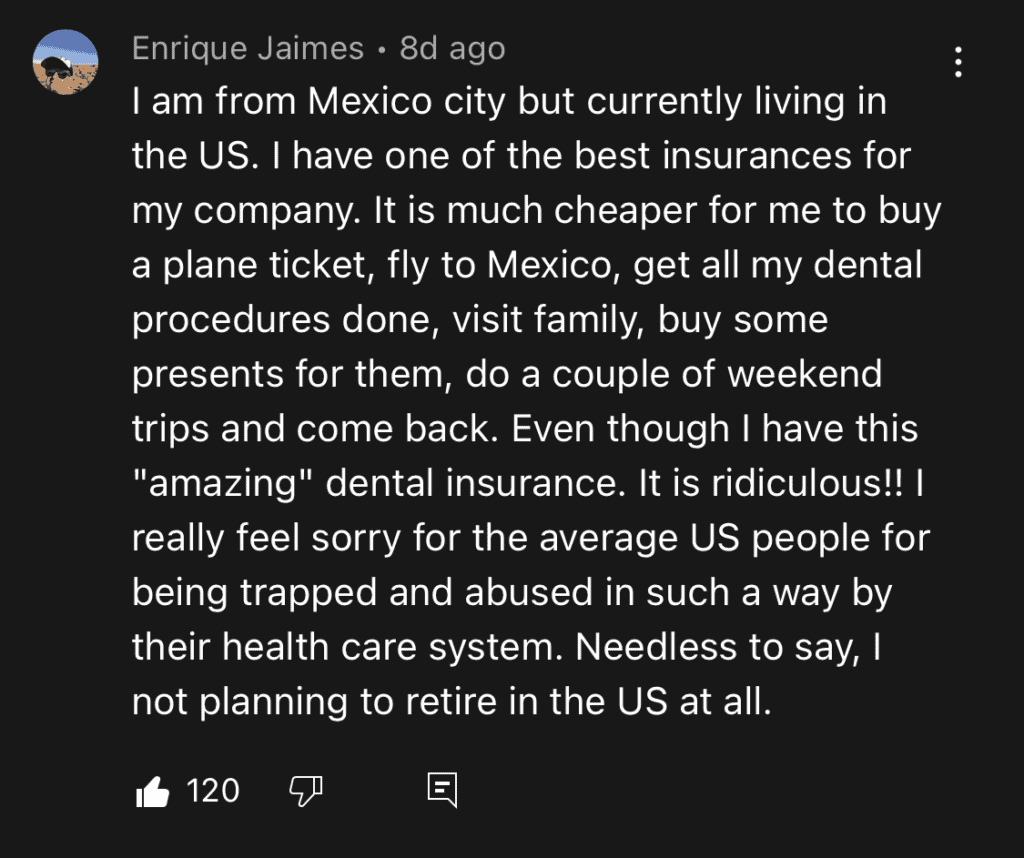

And you’ve probably heard about medical tourism in Mexico. It’s one of the most popular destinations for foreigners because you can receive amazing low-cost treatments and make a nice vacation out of it while you’re at it. And your total cost will still be lower than the same treatment north of the border.

But just how inexpensive is medical care really?

But Is Medical Care Truly Inexpensive in Mexico?

The short answer is- it depends on what you are being treated for. Yes, a lot of medical consultations and procedures are indeed a fraction of the cost when compared to the U.S. But what does that mean for you?

Well, to give you an idea, the cost to see a specialist such as a cardiologist or a gynecologist is usually $800-$1,000 MXN per visit without insurance. That’s about $40-$50 USD per visit if you had zero insurance in Mexico. Keep in mind this doesn’t include treatments, medications, or lab work. But even then, the costs for medications, lab work, and most outpatient treatments in Mexico are still significantly lower than in the U.S.

To see a general doctor, you can expect to pay less. Somewhere between $50-$400 MXN (about $2.50 USD-$20 USD).

Medications in Mexico also tend to be much, much cheaper. Most of the medications you would need a prescription for in the U.S. can be over the counter in Mexico.

Lab work is generally a lot less expensive in Mexico, also. For example, a full diabetes panel test costs around $800-$1000 MXN without insurance in Mexico. The same panel in the US has an average cost of $2000-$2200 MXN or about $100-$110 USD.

And surgical procedures, although still considered expensive by most local Mexicans, are considerably lower than north of the border. A simple comparison puts a hip replacement at about $12,500 USD in Mexico vs. $40,000 USD for the same procedure in the U.S. without insurance.

The following chart was put out by a popular hospital in Mexico, CMQ- and is a comparison of surgical procedures in the U.S. vs. Mexico and other countries with medical tourism. As you can see, most medical procedures in Mexico are considerably lower in cost than the same surgery in the U.S.

But What About Getting Private Health Insurance?

Here is a Q&A I did with a health insurance broker in Mexico to help clarify some of the most pressing questions about health insurance in Mexico and pre-existing conditions.

In case you missed it, the replay is available here.

In the video, our guest and our recommended expert explained why some pre-existing conditions are not covered by private healthcare insurance and what alternatives you have.

Healthcare insurance in Mexico can be affordable and very expensive. It all depends on age, current health, coverage amounts, and international vs. local coverage.

To give you an idea

- a 71-year-old man with a $65,000 MXN yearly deductible (about $3,515 USD)

- Has a yearly premium of $75,000 MXN, about $4000 USD or $340 USD monthly.

- This is for coverage in Mexico only.

- Now, compare that to the U.S. national average premium of $600 USD a month if a person is 64 years and older- that’s half the cost!

But then again, if you are from the U.S. and qualify for Medicare, you have access to some Medicare Advantage plans, which can provide emergency coverage for you in Mexico.

To learn more about using Medicare Advantage in Mexico for emergencies, please consider watching this Q&A I did with Jeff, a Medicare Advantage Expert we recommend working with.

What If You Cannot Afford Private Health Insurance?

Remember that although private health insurance in Mexico is usually cheaper than in the U.S., it may still be too expensive for you and your monthly budget.

So, What Should You Do?

Many expats choose to enroll in the government-sponsored medical program known as IMSS or Instituto Medico del Seguro Social because the premiums are extremely affordable compared to private healthcare insurance. However, you should be aware that some pre-existing conditions will also deny you coverage through the IMSS.

These include:

- Malignant tumors.

- Chronic degenerative diseases such as late complications of diabetes mellitus; hoarding diseases (Gaucher disease); chronic liver diseases; chronic renal insufficiency; heart valve disease; heart failure; sequelae of ischemic heart disease (arrhythmia, angina, or myocardial infarction); chronic obstructive pulmonary disease with respiratory failure;

- Chronic systemic diseases of the connective tissue.

- Addictions such as alcoholism and other drug addictions.

- Mental disorders such as psychosis and dementia.

- Congenital diseases or disorders

- Acquired immunodeficiency syndrome or Human Acquired Immunodeficiency Virus (HIV) positive.

Some Caveats About the IMSS

And there are also some waiting periods to get full coverage. A waiting period means you cannot get covered for specific treatments until a period of time has passed.

Diseases with waiting periods

Six months:

Benign breast tumor.

Ten months:

Childbirth or Labor

One year:

Lithotripsy

Surgery for gynecological conditions, except for malignant neoplasms of the uterus, ovaries, and pelvic floor muscles.

Surgery for venous insufficiency and varicose veins.

Sinus and nose surgery.

Varicocele surgery.

Hemorrhoidectomy, rectal fistula surgery, and rectal prolapse.

Tonsillectomy and adenoidectomy.

Hernia surgery, except intervertebral disc herniation.

Hallux valgus surgery.

Strabismus surgery.

Two years:

Orthopedic surgery.

It is also worth noting that IMSS Hospitals vary in quality based on their location. Bigger cities will have multiple hospitals, whereas smaller communities will only have one. Another thing to note is that IMSS public hospitals may have:

- Long lines and wait times- you are waiting along with everyone else who doesn’t have private insurance.

- Availability of specialists during off-hours or holidays

- And in some cases, run-down facilities with outdated equipment

- You usually do not have a private room- 4 beds to a room is common.

- You must have someone with you 24/7

- No English-speaking staff in most cases

- Medications can sometimes be scarce

- Wait for days or weeks for more serious surgeries- which can be very uncomfortable.

IMSS Yearly Premiums for 2024

These are some of the reasons we buy private health insurance if we can afford it. But IMSS might be the only option for you if private health insurance is unaffordable or if you are over the age where any private insurance company in Mexico will NOT cover you as a new customer.

The following are the yearly premiums for IMSS:

IMSS Fees as of 2025

| Age Range | Annual premium in Mexican Pesos |

|---|---|

| 0-19 | $8,900 |

| 20-29 | $11,100 |

| 30-39 | $11,850 |

| 40-49 | $13,800 |

| 50-59 | $14,250 |

| 60-69 | $19,800 |

| 70-79 | $20,650 |

| 80 y más | $21,300 |

IMSS Fees are in Mexican Pesos

So With All This Info, What Should You Do?

That question depends on YOU!

Your current health, your financial situation, your lifestyle, and so on.

If you are a healthy individual under the age of 70, I’d recommend getting a quote from a reputable insurance broker that represents a variety of companies in Mexico. That way, you get a few quotes and can choose the best one based on your needs and budget.

I’d also recommend signing up for Medicare when you turn 65 if you are from the U.S. and adding Medicare Advantage- This will cover you if you travel back to the U.S. and will also cover life-threatening emergencies in Mexico.

If you cannot afford private health insurance in Mexico and qualify for IMSS- I’d suggest applying for it. At the very least, you’ll have some coverage in Mexico.

And most importantly, I recommend saving. Each month, you should put aside some money to cover medical emergencies in Mexico. Many Mexican hospitals expect a deposit upfront if you do not have insurance. Sometimes it’s as low as $5000 pesos, but it can be 100,000 pesos or more (about $5,000 USD). (If you have insurance, most carriers will give you a list of in-network hospitals that don’t require a deposit)

I mention this because you might move to Mexico to enjoy your retirement and live off your savings. You might self-insure and not have health insurance. But when an expensive treatment is needed, and you need to pay upfront in cash, you could get wiped out of your savings fast.

And unfortunately, I have seen many people leave Mexico because they ran out of money from a medical emergency. Or start a GoFundMe to help cover costs.

The best thing to do is plan ahead. The last thing you want is to stress out about medical bills when you have a medical emergency.

I hope this long but important email has been helpful. My goal with Mexico Relocation Guide is to give you as much transparent information as possible so you can decide if moving to Mexico is right for you. And when you’re ready to make the move to Mexico, we help you do it the right way! 😃

Take The Next Step With Confidence

If you’re considering a move to Mexico, our Complete Mexico Relocation Guide can help you do it with confidence.

Our guide provides instant access to all the essential steps for relocating to Mexico, from navigating healthcare options to finding long-term rentals, obtaining your Mexican Residency, and more.

Plus, you’ll receive our exclusive directory of vetted contacts, including recommended health insurance brokers, real estate professionals, immigration experts, and more. With our guide, you can have peace of mind knowing you’re prepared for every aspect of your move. Start your journey to a new life in Mexico today by checking out the Complete Mexico Relocation Guide!