The RFC or Federal Taxpayers Registry is a unique registration code that identifies every person who carries out an economic activity in Mexico where taxes are collected or have to be paid to the SAT (the Mexican equivalent of the IRS).

As of 2023, the SAT requires all Mexican citizens and residents over 16 to obtain one. Even if you don’t plan to run a business or work in Mexico. SAT is the equivalent of the IRS if you’re from the USA or the CRA if you’re from Canada.

Why is this significant?

This measure was enacted to combat money laundering and develop a method to ensure that the proper taxes are collected from businesses and the general population through SAT, which is Servicio de Administración Tributaria. SAT is the equivalent of the Internal Revenue Service in the US or the Canada Revenue Agency in Canada.

If you are a Mexican business, all purchases of materials and supplies must be made on a FACTURA, which is a generated tax document. As part of this change, a new FACTURA system called FACTURA 4.0 will be going into effect, requiring businesses to obtain and use each client’s RFC or face monetary penalties.

Who’s eligible for an RFC number?

Any person living in Mexico who is over the age of 16 and plans to either earn an income or be involved in financial scenarios such as:

- Opening a bank account

- Paying taxes

- Setting up utilities with the purpose of being able to use it as a tax deduction,

- Buying a new car from a dealership

- Selling property in Mexico

- As of 2023, it is required by law to have an RFC if you’re a resident or national buying property in Mexico.

When You Need an RFC

As of 2022, the Mexican government has made it mandatory that anyone over 16 who lives in Mexico, regardless of whether they plan to pay taxes or not, has to apply for an RFC. This means that even temporary and permanent residents are required to apply.

The law went into effect because there was a problem with the previous system, making it too easy to make counterfeit tax receipts, and there was a lot of fiscal identity theft. They changed the way “facturas,” or tax receipts, are issued by companies to make it harder for criminals to falsify these receipts.

Some of the reasons you will need an RFC include:

- Working in Mexico

- Buying a property

- Submitting “facturas” when you sell a home in Mexico to avoid capital gains

- Opening a bank account in Mexico

- Buying a car from a dealership

- Setting up new utilities with the CFE or other

Now a lot of you will never need an RFC in Mexico. Especially if you rent and your utilities are in your landlord’s name. Or if you never have a bank account in Mexico. Or if you never plan on buying a new car from a dealership. Most expats moving to Mexico will never work for a Mexican employer and, therefore, will never have a tax liability. However, I still think it’s a good idea to obtain yours.

You will also need an RFC when you form a corporation and run a business in Mexico.

Many medical procedures will not be reimbursed UNLESS You have a factura or official receipt for which you NEED an RFC.

Capital Gains Exemptions Allowed

A one-time tax allowance exemption is available under Article 92, Fraction XIX of Mexican income tax law, which reduces the tax liability up to every two years for many family homes.

Although you and the property must meet certain criteria to qualify for the exemption:

- You must be resident in Mexico* with a Mexican tax ID (known as an RFC, or Registro Federal de Contribuyentes) and

- The property you’re selling must be your primary residence, and

- You can prove you have been living in Mexico 183 days out of the recent year

- The land subject to the sale must not exceed three times the size of the construction on that land (measured in square meters), and

- You can only claim this exemption once every three years.

So, if you plan to get this tax exemption for capital gains on your home, you need an RFC. When you get your RFC, you check the correct motive for the RFC to be used for tax purposes.

However, this tax exemption is not automatically taken into account. Your Notario or Notary will decide if you qualify for this deduction.

Here’s a rewritten version of the text in your own words:

How to Schedule Your Appointment Online

- Go to https://citas.sat.gob.mx/ and click on “Registrar Cita” to begin.

- Choose the option “Inscripción al padrón de contribuyentes Personas Físicas.”

- Fill in the required details, including your CURP number, full name (as it appears on your resident card), email address, and email confirmation. Then, click “SIGUIENTE.”

Note: You can print your CURP at https://www.gob.mx/curp/. - On the next page, use the drop-down menus to make your selections:

- SERVICIOS: Choose “Inscripción en el RFC de Personas Físicas.”

- Distrito Federativo: Select your state of residence.

- Módulo: Pick the SAT office and town closest to you.

- The system will inform you that in-person visits are unavailable, and you’ll need to join a Fila Virtual (virtual queue).

- Click Fila Virtual to proceed.

- A security token will be sent to your email. Retrieve the token, enter it in the box, and click Reenviar. (to resend)

- You’ll see a confirmation screen indicating your position in the virtual queue. Keep an eye on your email for updates about available appointment slots.

To check your queue status, log back into the website and select CONSULTAR CITA. (consult your appointment)

In-Person Appointment Process

If you’d prefer to complete the process in person or through a representative, you’ll first need to schedule an appointment with the SAT. When attending your appointment, bring the following items:

- Official ID

- Proof of address

- USB flash drive

Additional documents may be required depending on the system’s instructions when scheduling your appointment. Make sure to follow any specific requests provided during the process.

For Citizens of Mexico

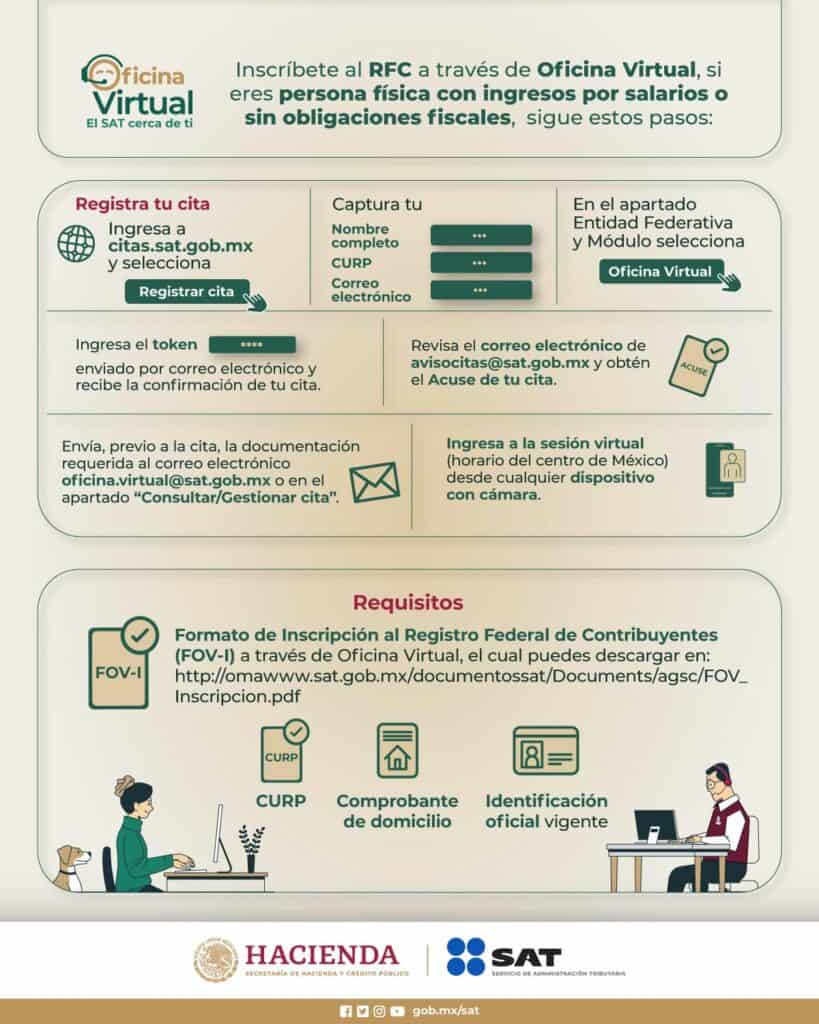

Recently, SAT announced the ability for citizens of Mexico who are “personas fisicas,” or individuals who are not businesses, to obtain their RFC without having to step foot in the SAT offices.

The process still requires making an appointment, but the difference is you will upload all of the required information and complete the process online. The process is not instant; you will still need to log in virtually after your information has been reviewed and you receive the time and date to log in and complete the process. There is no timeline mentioned for how long this takes.

ONLINE RFC REGISTRATION APPLICATION FOR INDIVIDUALS (persona fisica)

1. Request an appointment on the citas.sat.gob.mx site or in the ‘Register appointment’ section. You can use Google Translate to translate the page to English.

2. Fill in the required data, such as name, CURP, and email.

3. Select the option ‘Virtual Office’ as the Federal Entity and Module.

4. Enter the token that is sent to the email you provided.

5. Send the required documentation by email or through ‘Consult/Manage appointment.’

6. On the day of the appointment, log in virtually to complete the procedure

Cons of Getting an RFC Online

Obtaining an RFC online is a huge plus for expats who don’t live in Mexico full-time or for those who aren’t planning to make any changes to SAT in the future, such as changing their address or their fiscal classification.

HOWEVER

There is a downside to obtaining your RFC online. You will not be able to set up an e-Firma. Your E-Firma is a biometric that can only be set up in person at the SAT offices. Without your E-firma, you cannot make any changes with SAT regarding your address or change your fiscal status in the future.

We still think obtaining it online is a great option, and we’re glad that the SAT has made strides in modernizing the process. However, we do recommend obtaining your RFC in person if possible to also set up your e-Firma.

What are the required documents to get an RFC number?

You don’t have to be a resident or national in Mexico to obtain an RFC. Foreigners can also apply for one. As an individual, you’ll need your

- CURP (see below) or birth certificate.

- Proof of address (original utility bill not older than 90 days)- doesn’t have to be in your name.

- An official ID- your Mexican passport or resident card.

- Businesses need to prove they’re incorporated and that the person registering the company is authorized.

- Determining what purpose you need the RFC for, known as “tipo de movimiento“

- A flash drive or thumb drive.

- A Mexican Phone Number.

- At some SAT offices you will need a letter of intent if you are a temporary resident. See the template below

RFC-letter-of-intent-for-temporary-residents-1Download

Buzon Tributario

SAT requires most people with an RFC to apply for a Buzon Tributario. Failure to do so can mean fines of $3,850.00 a $11,540.00 MXN. The Buzon Tributario is an online communication channel between the SAT and taxpayers. Its objective is to simplify the notification of administrative acts and the sending of messages of interest in an agile and secure manner.

Also, through the buzon tributario, taxpayers submit any applications for discounts and notices or comply with information requests made by the SAT. For a buzon tributatrio you must have 2 forms of communication- an email and a Mexican phone number.

It’s important to note that not everyone with an RFC is OBLIGATED to register for a buzon tributario. You are exempt if you have an RFC that has a fiscal regime of: sin obligaciones fiscales (someone who doesn’t work), or anyone without economic activity (a person who didn’t generate an income in Mexico). In this case, enabling the buzon is optional.

You are also exempt if you generated an income of less than $400,000.00 (four hundred thousand pesos 00/100 MN) in the preceding fiscal year.

Learn more about the Buzon Tributario on the SAT Website, or talk to a professional accountant in Mexico.

RFC Frequently Asked Questions

Does the need for a FACTURA affect the general Expat Population?

Not Unless you have formed a Corporation to buy your property or are required to file taxes in Mexico due to rental income. Generally, when you pay for items, you will be asked for NOTA or FACTURA at the point of sale.

Your response is NOTA or a simple receipt if you have NO tax liability. If you have a Corporation or business here in Mexico or are required to pay taxes, you will need the FACTURA. I suggest you consult a CPA/Accountant in Mexico who is familiar with SAT regulations for all filings.

Isn’t an RFC just a number?

No, the actual RFC document is very similar to your CURP document. It has a QR Code, a Bar Code, your 13-digit RFC Number, CURP, Name, address, and tax identifiers.

So why can’t I use the Generic RFC issued by SAT if I’m a Resident or National?

First, the Generic RFC was created as a workaround in the Tax System for certain tramites (legal procedures) involving foreigners or nationals without an RFC.

The Generic RFC was only valid in certain instances when the purchaser was not eligible for an RFC issued by SAT.

Mexican Companies can be fined for its use, or the Computer Generated Systems will no longer accept it as a valid number.

Which invoices or Accounts require an RFC?

Any invoice to be used, which could be used as a tax deduction or fulfill your requirements to pay taxes, requires an RFC.

Utility bills here in Mexico are not only invoices. They are bonafide tax documents used as tax deductions for businesses. For this reason, going forward, utility companies such as CFE, Aguakan, Telmex, Telcel, etc. will ask you to update your account information with your RFC and provide a Constancia de Situación Fiscal…more on this later.

Banks have also begun asking for RFC numbers and Constancia’s for Residents wanting to open accounts. The generic is not applicable in this instance.

Can I still open a Bank Account without Residency or As A Tourist?

Yes. However, there is a limited number of banks that will open accounts for foreigners who do not have a residency card and/or an RFC Number.

Currently, Banbajio, Santander, and Intercam will still open accounts for Non-Residents and those individuals without an RFC. But no one can guarantee this will always be the case. Changes in Mexican policy can happen overnight or take ages to go into effect.

Can I buy a new car in Mexico without an RFC?

Probably not, and the generic is not applicable in this case because a Car Factura is also a Tax Document, and the sale is instantaneously recorded in SAT.

I’m not a Resident or National. Will I still be able to set up utilities in my name?

Yes. In this instance, since you do not fall under the requirement to have an RFC or a Constancia de Situacion Fiscal, a generic RFC can be used.

Can I hire someone to help me?

Yes, some professionals can help you get your RFC. This is especially helpful for those who would like to have someone help them obtain an in-person appointment and their e-Firma.

BUT- Be careful who you hire to help you get your legitimate RFC. Some scammers have been promising expats the issue of an RFC, only to find out that they belong to someone else or are a fake number.

To work with reputable people, check out our COMPLETE Mexico Relocation Guide. In the guide, we give you access to our recommended contacts.